Real Estate Investment Opportunities in Singapore

As Singapore continues to solidify its position as a global financial hub, the city-state's property market presents compelling investment opportunities for older investors looking to diversify their portfolios. This analysis delves into current trends and potential prospects in Singapore's real estate sector.

Current Market Trends

Singapore's property market has shown remarkable resilience and growth in recent years, driven by several factors:

- Limited Land Supply: With its small geographical footprint, Singapore's land scarcity continues to drive property values upward.

- Strong Economic Fundamentals: The city-state's robust economy and political stability attract both local and foreign investors.

- Infrastructure Development: Ongoing improvements in transportation and urban planning enhance property values in various districts.

- Government Policies: Prudent regulations help maintain market stability and prevent speculative bubbles.

Investment Opportunities for Older Investors

For retirees and older investors seeking to capitalize on Singapore's real estate market, several options are worth considering:

1. Residential Properties

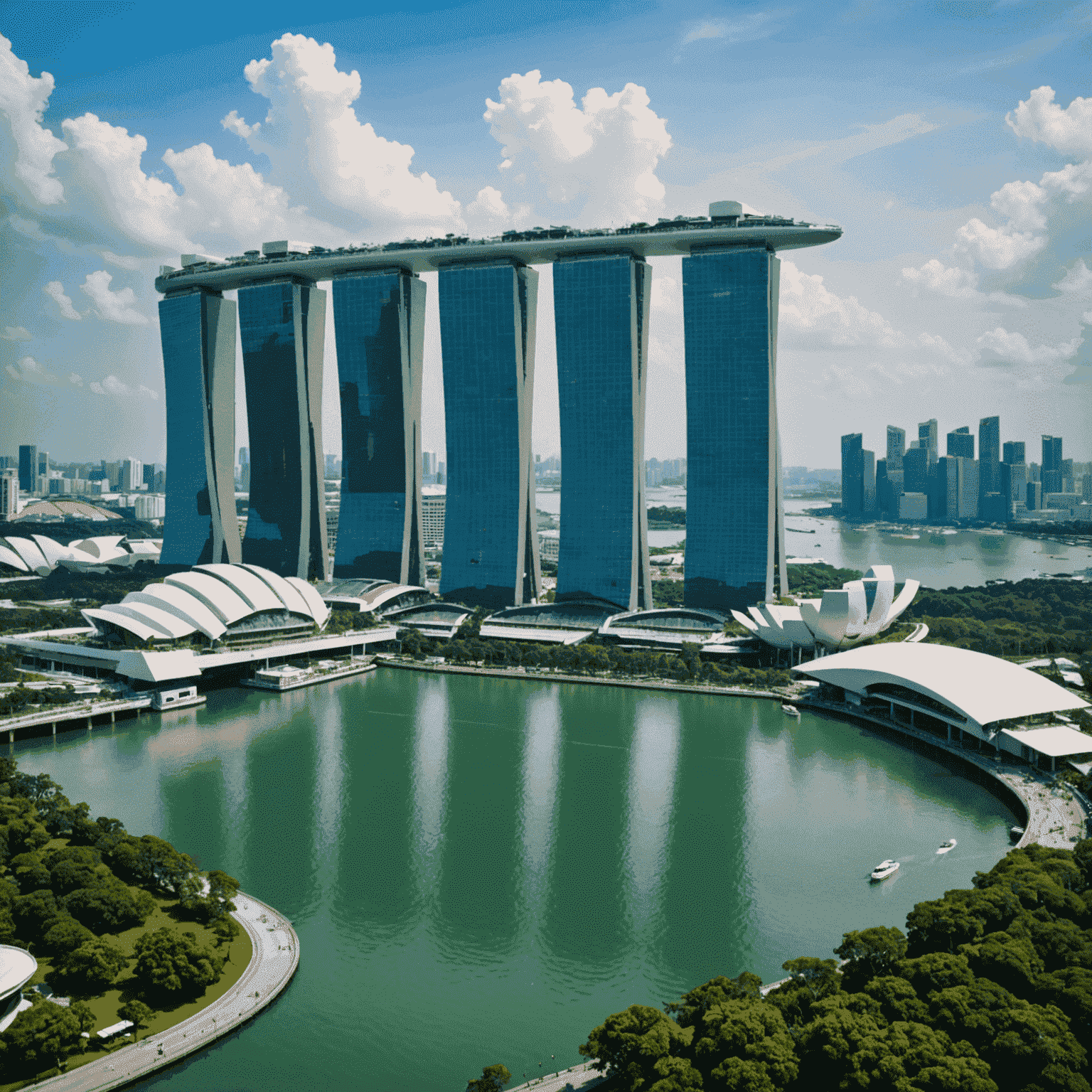

High-end condominiums and landed properties in prime districts offer potential for capital appreciation and rental income. Areas like Orchard Road, Marina Bay, and Sentosa Cove remain popular among affluent buyers and tenants.

2. Commercial Real Estate

Office spaces in the Central Business District and retail properties in suburban malls can provide stable rental yields. The growing trend of decentralization also opens up opportunities in regional centers.

3. REITs (Real Estate Investment Trusts)

Singapore-listed REITs offer a lower-risk entry point into the property market, providing regular dividend income and potential for capital growth. They cover various sectors including office, retail, industrial, and healthcare properties.

4. Shophouses

These unique heritage properties combine historical charm with commercial potential. Located in prime areas, they often appreciate well and can be repurposed for various uses, from offices to boutique hotels.

Considerations for Older Investors

While Singapore's real estate market offers attractive prospects, older investors should keep the following factors in mind:

- Liquidity Needs: Consider how quickly you might need to access your invested capital.

- Risk Tolerance: Assess your comfort level with market fluctuations and potential policy changes.

- Diversification: Ensure real estate investments complement your overall portfolio strategy.

- Management Requirements: Evaluate your willingness and ability to manage properties directly versus more passive investments like REITs.

Conclusion

Singapore's real estate market continues to offer compelling opportunities for older investors seeking to diversify their portfolios. With its strong fundamentals, transparent regulations, and diverse property types, the city-state remains an attractive destination for real estate investment. However, as with any investment decision, it's crucial to conduct thorough research, consider your personal financial goals, and consult with financial advisors to make informed choices that align with your retirement planning strategy.