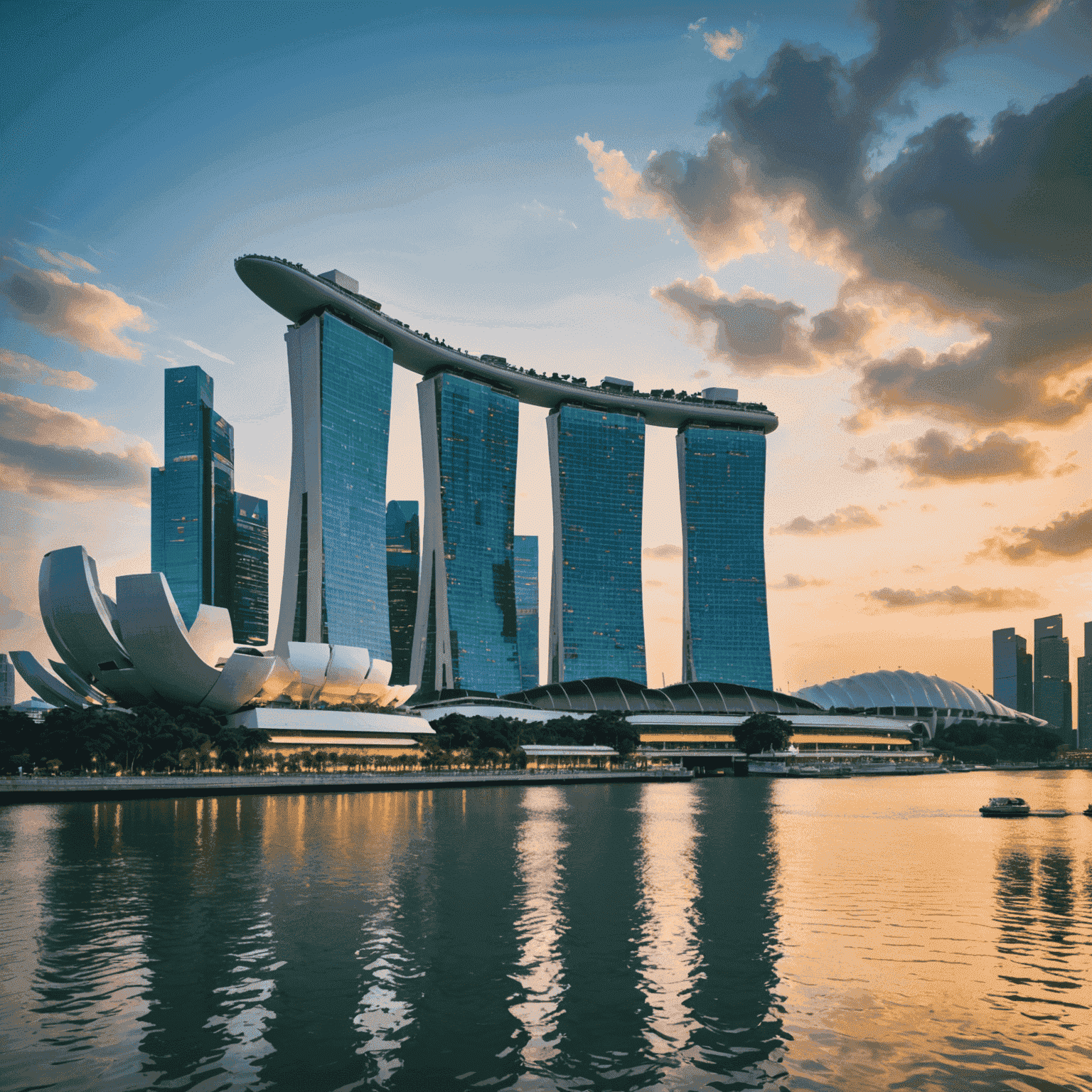

Retirement Planning in Singapore: A Comprehensive Guide for Older Investors

As Singapore continues to evolve as a global financial hub, retirement planning has become increasingly important for older investors. This guide explores the various strategies and options available to ensure a comfortable and secure retirement in the Lion City.

Understanding the CPF Scheme

The Central Provident Fund (CPF) is the cornerstone of retirement planning in Singapore. For older investors, it's crucial to maximize the benefits of this comprehensive social security system:

- CPF LIFE: A national longevity insurance scheme that provides lifelong monthly payouts

- Retirement Sum Topping-Up Scheme: Allows you to top up your Special Account or Retirement Account for enhanced retirement savings

- CPF Investment Scheme (CPFIS): Offers opportunities to invest your CPF savings in a variety of financial products

Private Investment Options

Beyond the CPF, Singapore offers a wealth of private investment opportunities for retirees and older investors:

- Singapore Savings Bonds (SSB): A low-risk investment backed by the Singapore government, offering step-up interest rates

- Real Estate Investment Trusts (REITs): Singapore is a REIT hub, providing stable income through property investments

- Dividend Stocks: Blue-chip companies listed on the Singapore Exchange (SGX) often provide reliable dividend income

- Fixed Deposits: Local banks offer competitive rates for term deposits, suitable for conservative investors

Retirement Income Streams

Diversifying your retirement income is key to financial stability. Consider these options:

- Annuities: Private insurance companies offer annuity plans complementing CPF LIFE

- Rental Income: Investing in residential or commercial properties can provide a steady income stream

- Part-time Work: Singapore's Silver Workforce initiatives support flexible employment for seniors

Healthcare Planning

A crucial aspect of retirement planning is preparing for healthcare costs:

- MediShield Life: Understand and optimize your basic health insurance coverage

- Integrated Shield Plans: Consider supplementing MediShield Life with private insurance

- ElderShield and CareShield Life: Long-term care insurance schemes for severe disability

Estate Planning

Ensure your assets are distributed according to your wishes:

- Will Writing: Clearly outline the distribution of your assets

- Lasting Power of Attorney (LPA): Appoint a trusted individual to make decisions on your behalf if you lose mental capacity

- Advance Medical Directive (AMD): State your preferences for end-of-life medical care

Staying Informed and Seeking Advice

The financial landscape is ever-changing. Stay informed through:

- Financial literacy programs offered by government agencies and community centers

- Consultations with licensed financial advisors specializing in retirement planning

- Workshops and seminars organized by CPF Board and other financial institutions

Key Takeaways for Older Investors

- Maximize your CPF contributions and understand the various schemes available

- Diversify your investments across different asset classes to balance risk and returns

- Plan for healthcare costs and long-term care needs

- Regularly review and adjust your retirement strategy as your needs and market conditions change

- Seek professional advice to optimize your retirement planning in the context of Singapore's unique financial landscape

Retirement planning in Singapore offers a wealth of opportunities for older investors. By leveraging the robust CPF system, exploring private investment options, and staying informed about the latest financial products and strategies, you can build a secure and comfortable retirement in one of Asia's most dynamic economies.